What to know about the new SAVE student loans repayment plan

The Saving on a Valuable Education (SAVE) Plan is a new income-driven repayment (IDR) plan that was introduced by the Department of Education in July 2023. The SAVE Plan is designed to make student loan payments more affordable for borrowers with low or moderate incomes.

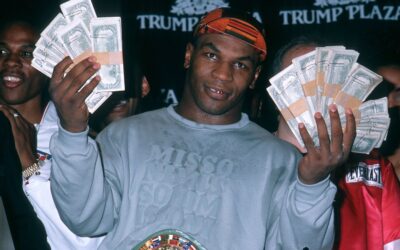

Famous Chapter 7 and Chapter 11 Bankruptcy Filings from Greenway Law Group in Birmingham, Alabama

In a world where financial success is often glamorized, it’s easy to forget that many famous individuals have faced severe monetary struggles and even filed for bankruptcy. At Greenway Law Group in Birmingham, Alabama, we believe in the power of recovery and the resilience that comes with it. To inspire our clients, we’re showcasing a few renowned individuals who filed for bankruptcy and managed to bounce back stronger.

Protecting Yourself from Dangerous Collection Scams

When facing financial difficulties, the last thing you need is to fall victim to dangerous collection scams. Unfortunately, scammers prey on vulnerable individuals and the elderly, attempting to exploit their fears and trust. Many times, clients who have received a...

How Do I Make My Birmingham Chapter 13 Bankruptcy Payments?

How to pay your chapter 13 payment for bankruptcy cases filed in the Northern District of Alabama (Birmingham), Southern Division.

How Social Media Is Helping Collectors

How Social Media Has Changed Debt Collection In the past decade, technology has drastically changed how people manage their finances and interact with financial services. With the advent of social media and sites such as Instagram, Facebook and Tik Tok playing a more...

Update on Student Loan Forgiveness

On April 19, 2022, the U.S. Department of Education (ED) announced several changes and updates that will bring borrowers closer to forgiveness under income-driven repayment (IDR) plans. These adjustments to borrower accounts include conducting a one-time revision of...

How to Make Your Chapter 13 Payments

Chapter 13 debtors can now make plan payments electronically through Court Compass. Visit www.courtcompass.com today to learn more. Chapter 13 debtors can now make plan payments electronically through TFS Bill Pay. Visit www.tfsbillpay.com, or call TFS at (888)...

Debts that May Not be Discharged

Though filing for bankruptcy can be the ultimate recourse for some individuals who have been left with overwhelming debts, people should understand that in some instances there are debts that may still remain that debtors need to settle. Below are the following debts...

Choosing Between a Chapter 7 or Chapter 13

Many times when I meet with a client, they have no idea whether they need a Chapter 7 or a Chapter 13 case. The concepts between the two can confuse even a seasoned lawyer, so there is no doubt that many consumers feel overwhelmed when looking at their options....

Holiday Spending

Holiday spending can get out of hand. A good rule of thumb is not to put more on your credit cards that you can pay off in three months time. Overspending can lead to problems when the bills come in and interest begins to accrue. Spend wisely. Chapter 7 bankruptcy and...

Choosing Between Chapter 7 and Chapter 13

Many times when I meet with a client, they have no idea whether they need a Chapter 7 or a Chapter 13 case. The concepts between the two can confuse even a seasoned lawyer, so there is no doubt that many consumers feel overwhelmed when looking at their options....

DON’T LOSE YOUR HOME

Things Birmingham homeowners should ask when protecting home from foreclosureBirmingham homeowners often find it difficult to defend their home in a foreclosure procedure due to the fact that the state follows a “nonjudicial foreclosure” procedure. Struggling...

Debts that may remain after a bankruptcy procedure

Though filing for bankruptcy can be the ultimate recourse for some individuals who have been left with overwhelming debts, people should understand that in some instances there are debts that may still remain that debtors need to settle. Below are the following debts...

Things Alabama homeowners should know about foreclosure process

Homeowners should know how the foreclosure process works in Alabama for them to better avoid getting in trouble with lenders once they have started to be considered delinquent.In Alabama, foreclosure is primarily done outside the court (non-judicial) but does often...

Increasing Credit Card Debt

Financial experts have observed that though many people are earning more money, nationwide credit card debt is also on the rise, noting the $912 billion debt from January to June of this year.Experts noted that mitigating credit card debts could be considered “one of...

Rapper DMX trying to save house through bankruptcy filing

A December 29 article of Mail Online revealed that well-known rap artist “DMX” has filed for bankruptcy to possibly protect his house in New York and to settle his millions worth of debt to creditors.Reports said it is already the third time that the 46-year-old...

Millions may benefit from Trump’s student loan plan proposal

A December 14 article of Forbes revealed millions of people struggling to repay their student loan debts are expected to benefit from the proposal of president-elect Donald Trump.A month before the presidential election, Trump said in Ohio that student loan debts...

Counties in Alabama with low credit card debt

A recent study revealed that, compared to many states, Alabama’s households tend to have much lower credit card debt, a Thursday, December 8 article of al.com reported.The average credit card debt of households in all states is $15,675, but reports revealed that...

Nationwide foreclosure inventory decreases as completed foreclosures increase

A California-based real estate information provider observed that there was an increase in completed foreclosure procedures nationwide, but the foreclosure inventory has decreased, a November 8 article of Housing Wire reported.According to CoreLogic’s September data,...

Financial relief available for unemployed individuals

It is truly a frustrating situation for any person to have overwhelming debts, and it can be even more worrisome if a person just lost his or her job. Unemployed individuals and those who are underemployed with overwhelming debts should know there is a bankruptcy...

Lindsay Lohan might head for bankruptcy

Actress Lindsay Lohan might find herself heading for bankruptcy due to claims that she failed to settle the rent payments on her flat in London, an October 22 report of the Economic Times stated.The bankruptcy issue reportedly comes as the 30-year-old actress...